CS Accounting and Tax Services Inc

We've built a reputation as the accounting firm you can trust. From tax returns to bookkeeping, payroll to consulting, we deliver results for our clients.

Small Business Accounting

Businesses of all shapes and sizes depend on accurate, insightful financial information...

Read More >>

Payroll Services

Managing the employee payroll is not a simple matter of calculating the amounts due, writing...

Read More >>

Tax Services

Tax law is a complicated affair that changes with each season. Through rigorous professional...

Read More >>

QuickBooks Services

We provide an array of services to help you set up your business on QuickBooks...

Read More >>

Personal Financial Services

We’ll help you craft a financial roadmap to meet your obligations and manage risk.

Read More >>Welcome!

CS Accounting and Tax Services Inc. is an accounting financial services firm serving clients throughout the state of Hawaii, dedicated to providing our clients with professional, personalized services and guidance in a wide range of financial and business needs.

On this website, you will find information about CS Accounting & Tax Services Inc., including our list of services. We have also provided many online resources to assist in the tax and financial decision-making process. These tools include videos, downloadable tax forms and publications, financial calculators, news and links to other useful sites. Whether you are an individual or business, CS Accounting & Tax Services Inc. has years of valuable experience assisting professionals with their accounting needs.

We welcome any questions or comments you may have.

Contact Us

Industries Served

Associations • Attorneys • Consultants • Contractors • Dealerships • Dentists • eCommerce • Landlords • Physicians • Retail Stores • Restaurants • Schools • Social Services • Non-Profits • Veterinarians

About Us

Our relationships with clients extend beyond financial recordkeeping and reporting. We understand the dynamics that affect their personal and professional lives. We listen to their goals and dreams. We work collaboratively to develop plans that transform ambitions into reality.

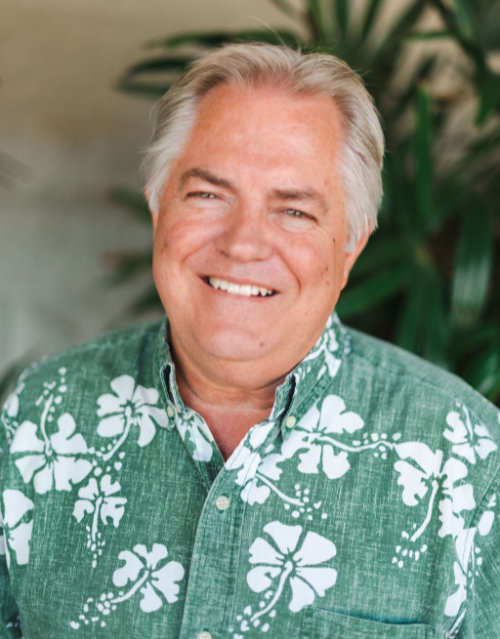

Matt Smith

CPA, President

I am the president at CS Accounting & Tax Services Inc., (CSATS) a CPA firm in Honolulu, Hawaii specializing in accounting and tax consulting for small businesses and individuals. My career path has not been a typical one for an accountant and has allowed me a broad range of experiences. Prior to joining CSATS, I was the Director of Financial Reporting at The Gas Company (now Hawai’i Gas), a gas utility company in Honolulu and the Assistant Controller for Alexander & Baldwin in Corporate Accounting. At both companies I was responsible for corporate reporting both internal and external to the company as well as budgeting, planning and internal controls.

I began my accounting career as an auditor with Ernst & Young in the Honolulu office where I was an audit manager before joining Alexander & Baldwin. As an auditor I was fortunate to experience a wide variety of industries that still provides benefits many years later.

Before my CPA career I served as a nuclear trained mechanical engineer aboard two fast attack submarines based in Pearl Harbor, and had the opportunity to visit many countries along the Pacific Rim. After my tour of duty in the US Navy I brought my engineering experience to the H-Power plant in Kapolei, Hawaii where I was fortunate to be part of the startup team bringing the plant into operating status.

I am a CPA licensed in Hawaii. I attended the Hawaii Pacific University for my accounting degree and the University of Hawaii for my MBA (EMBA 14). I live in Mililani with my beautiful wife and 2 young princesses.

Let's Start Talking

Let's discuss your situation so that we may understand your objectives and determine whether we have the ability to provide service and value.

30 minutes free initial consultation

Call (808) 537-5714